- Debtors who avoid filing a necessary bankruptcy often end up in litigation with creditors. Because the litigation will most likely not end in extracting payment from the debtor, the creditor wastes money on filing the lawsuit and communities lose precious resources that could be used to process more fruitful litigation. If the debtor had just gone on to file an inevitable bankruptcy, these resources would be preserved.

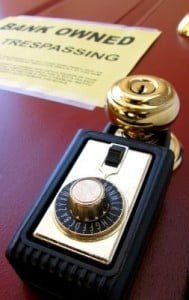

- Debtors who avoid a necessary bankruptcy filing often end up losing their home to foreclosure. Foreclosure doesn’t just negatively impact the homeowner; but it also harms the community. Communities with foreclosures lose financial value, aesthetic value and are less safe than communities with homes that are filed with families.

- Debtors who avoid a necessary bankruptcy filing often experience a heightened level of stress because they see no way out of their indebtedness. Extra stress can reduce worker productivity and cause negative behavior in the person suffering from the stress. Communities and workplaces that are filled with stressed out residents and workers are more prone to violence and workplace accidents.