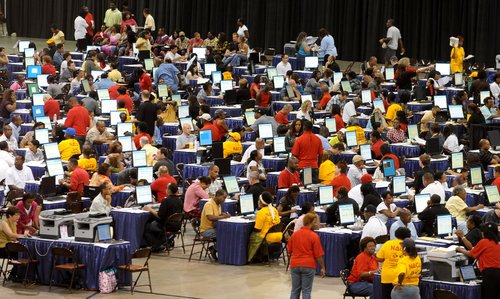

Thousands of people showed up in the wee hours of the morning to get help from a homeowner advocacy group dedicated to helping homeowners avoid foreclosure . The program, called “Save The Dream” is set up almost like a job fair; but instead of jobs, it is home mortgage modifications that homeowners are looking to win.

Shirley McCoy became the 1,117th person in line when she arrived at 6:10 a.m. She’s a widow with cancer on a fixed income, and she bought her home with more than 50 percent down.

“I’m never late, I make every payment, but I still get denied,” said McCoy.

Wachovia Bank has rejected her twice for refinancing, but she vows to continue to fight as long as she can.

Shirley, like many other homeowners who showed up for the “Save The Dream” program is underwater on her home mortgage. She owes much more than her home is worth. She wants to modify her mortgage so that it reflects the home’s true worth; but of course the mortgage company isn’t budging.

When a homeowner is 25% or even 50% underwater with their home mortgage, they are basically sinking money into a black hole. They can’t resell the property, they’ve lost their down payment investment and they are not building any equity in their home because they true value of the home is dwarfed by the enormity of their mortgage. Many of these homeowners are facing foreclosure because they have no other real choice but to either walk away or get a serious modification on their mortgage. Many homeowners in this situation do a “strategic walk away” and file bankruptcy so that they aren’t stuck with a huge bill at the end of the day.