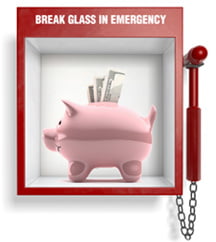

- One of the most common reasons that debtors fall behind on their bills and end up needing to file bankruptcy is the lack of an emergency fund. One of the most important foundations of financial security is having an emergency fund. A well funded emergency fund should cover at least 3 months of your expenses. Some experts even suggest that the best funded emergency funds will cover a person’s expenses for one year of more if they plan to avoid bankruptcy in case of long-term unemployment, a sudden illness, unexpected expenses or other crises.

- After a bankruptcy discharge, many debtors will begin receiving credit card offers that may be quite tempting. And while it is important that debtors begin rebuilding their credit history after bankruptcy, it is also important that debtors avoid accruing large amounts of debt. If possible, debtors should avoid carrying a balance on their credit card and if they do carry balance they should have a short-term plan for paying off that credit card debt. Avoiding high credit card debt is one of the best ways to avoid filing for bankruptcy a second time.

- Currently the high numbers of bankruptcy filings are being fueled by the rising levels of foreclosure. That’s why it’s important that debtors emerging from bankruptcy avoid buying more house than they can afford. Stretching your budget to the limit by buying a home that is too expensive is one of the surest ways to end up in bankruptcy again.