Donald Trump is the self-proclaimed “king of debt.” Before becoming president, he built his brand and companies with massive amounts of borrowed money.

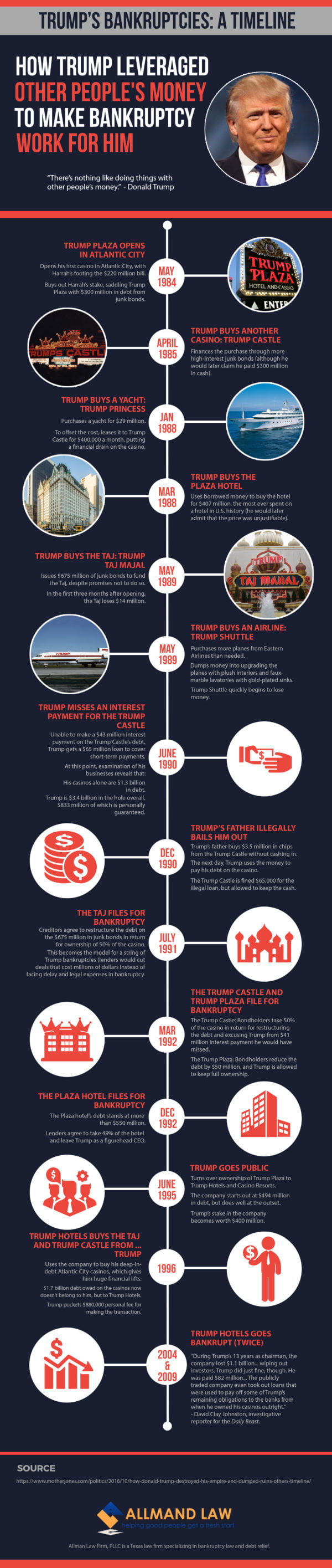

Allmand Law teamed up with James Publishing to illustrate this timeline by Mother Jones, outlining Trump’s Bankruptcies: How Trump Leveraged Other People’s Money to Make Bankruptcy Work for Him.

In the 1980s, Trump amassed casinos, hotels, an airline, and a 282-foot mega yacht. But his gold-plated bubble popped. By June 1990, Trump was unable to make loan payments on his $3.4 billion in outstanding debts. In total, Trump businesses filed for bankruptcy six times.

In many ways, Trump’s path to bankruptcy is just like that of many other business owners. His ambition was bigger than his financial resources. Risky business decisions didn’t play out as planned. And his attempts to restructure his debt were unsuccessful. But, in classic Trump form, there are flourishes of scandal. (His father illegally tried to bail his companies out.)

So how did he rebound and rebuild? Trump, along with his bankruptcy attorneys and financial advisors, used federal bankruptcy laws to their advantage. While investors and creditors lost a lot of their money, Trump was highly compensated for his day-to-day work, earned fees during the property transfers, and slashed his personal debts.

As with everything involving Trump, his bankruptcies are polarizing. He and his supporters argue that the casino industry was perilous in the 1980s and Trump simply used bankruptcy laws to his advantage. On the other hand, some critics claim that he made reckless decisions and took advantage of investors and the small businesses that worked with him. Regardless of how you view Trump and his business practices, learn more about his bankruptcies in this timeline.