Clark Howard shares some advice on how to improve credit scores.

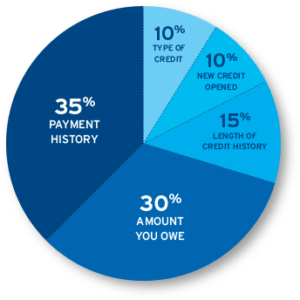

In order to improve your credit score, it is important to understand the factors that go into calculating your score. The chart below shows the 5 factors that go into improving credit. It also shows how much each factor matters when it comes to improving credit scores.

Payment History– This factor is the most important factor. “Not paying your bills on time can do serious damage to your credit score. Even if you’ve had some late payments in the past, you can improve your score going forward by paying each and every bill on time. Not paying your bills on time can do serious damage to your credit score. Even if you’ve had some late payments in the past, you can improve your score going forward by paying each and every bill on time.”

Amounts Owed– This is the second most important factor. This factor is calculated as a percentage. “The amount you owe divided by the total amount of credit you have available. It’s best to keep this under 30% — even better if you can keep it under 10%. So if your total credit line (between all of your credit cards and other loans) is $10,000, it’s good to owe less than $3,000 and great if you owe less than $1,000.”

Length of Credit History– The next most important factor is how long you’ve had credit. “This is determined by the date you opened your oldest credit account that’s still active. Since you can’t go back in time and open an account any earlier, the most important thing you can do in this area is to make sure you don’t close any of your old accounts.”

New Credit & Credit Mix– New credit & the type of credit amount for 10% each. New credit is credit that you’ve recently applied for. Any time you apply for credit, your score will drop. It won’t take long to recover. Just remember to only apply for credit you really need. “Your credit mix refers to the different types of credit you have.” Someone with just credit cards will be less favorable than someone with credit cards, a mortgage, and a car loan.

Bankruptcy is also a fast way you can fix your score! How? Click here to find out more!