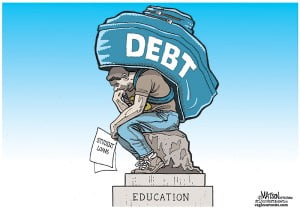

For-Profit College Student Loans Should Be Dischargeable In Bankruptcy

For-Profit Student Loans and Bankruptcy

According to a report released by the U.S. Department of Education, nearly half of student loan defaults come from for-profit colleges. Many for-profit schools receive up to 80% of their revenue from student loans; but their dropout rates are so high that in some instances the vast majority of students never receive a degree. As it stands now, it is extremely difficult to discharge student loans in bankruptcy, but many students who attend for-profit schools do not receive the same benefits as students attending more traditional universities.

Below are a few reasons why we need to make for-profit college student loans dischargeable in bankruptcy under certain circumstances:

High Failure Rate

Many for-profit colleges have a high dropout rate and/or eventually close down, leaving their students with either an unfinished education or a useless degree. Students should be allowed to discharge their student loans in bankruptcy if they were unable to finish their degree because of a school closure or if they were improperly recruited for degree programs which they were unqualified.

Financial Fraud

Students should be allowed to discharge their student loans in bankruptcy if the school was found engaging in fraudulent activity. Some schools are so dependent on student loan revenue that they fail to get students grant and scholarships for which the student qualifies. In some cases, the students are encouraged to take out more student loan money than they need leaving both the state and the individual student in financial trouble.

Bogus Education

Students should be allowed to discharge their student loans in bankruptcy if the school failed to deliver the education which they promised. Schools who fail to offer coursework which is necessary if the student wants to find a job in their field are engaged in fraud against the student. The bankruptcy court should have the power to discharge those student loans.

By getting tougher on for-profit colleges seeking to take advantage of the non-dischargeable status of student loans, we can decrease the number of student loan defaults across the board.

Have Questions About Student Loans and Bankruptcy?

If you have any questions about student loans debt we are always here to answer any of your questions. If you would like, you can call us or submit your questions and set up a free consultation by filling out our contact form .