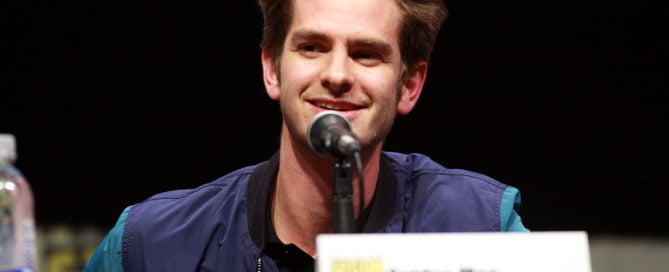

Andrew Garfield Claims Bankruptcy Was The “Best Thing” That Happened To His Family

Bustle reports that actor Andrew Garfield claims bankruptcy was one of the best things that has ever happened to his family. His roles in The Social Network and The Amazing Spiderman brought Garfield fame and success, but his family had not always been so financially fortunate. Garfield looks back on those finacial struggles and [...]